Ultimately, the human remains the final decision-maker, ensuring accountability and contextual judgment in critical scenarios.

The fintech and hedge fund sectors thrive on innovation, but adopting new technology comes with its own risks and responsibilities. Measured adaptation—like gradually integrating Agentic AI—allows organizations to innovate while maintaining stability and trust. In this post, we explore how emerging technologies, ethical considerations, and novel strategies are transforming the financial world.

What is Agentic AI?

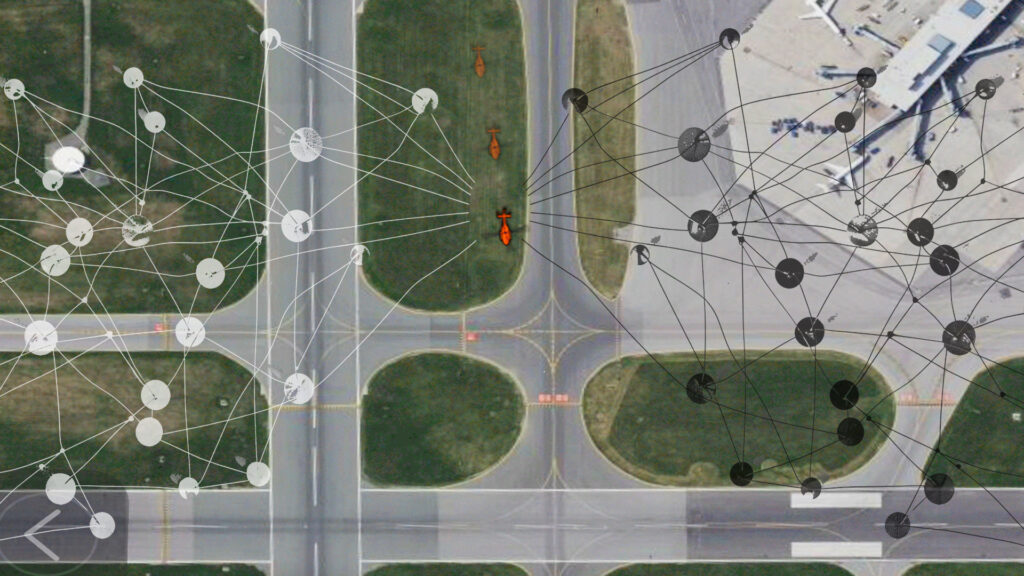

Agentic AI refers to artificial intelligence systems designed to operate as autonomous agents that can analyze data, make decisions, and execute tasks with minimal human intervention. In fintech, Agentic AI can be used to create “digital twins” of team members—virtual replicas that simulate human decision-making in a closed environment that enhance productivity and collaboration. By using Twins, companies can streamline routine and mundane processes, freeing the team members to focus more energy on mission and innovation.

Ultimately, the human remains the final decision-maker, ensuring accountability and contextual judgment in critical scenarios.

1. Emerging Technology: Driving the Next Wave of Financial Innovation

- AI-Powered Insights:

Hedge funds like Two Sigma have embraced machine learning to analyze non-linear relationships in market data, helping them outperform traditional quant models. The measured integration of AI ensures algorithm reliability before full-scale deployment. - Blockchain Beyond Bitcoin:

JPMorgan’s blockchain platform, Onyx, facilitates secure, efficient interbank payments. This cautious adoption of blockchain technology focuses on specific, scalable use cases instead of speculative ventures. - Quantum Computing:

Although still in its infancy, quantum computing firms like D-Wave are collaborating with financial institutions on experiments in portfolio optimization. A measured approach involves using quantum technology for supplementary analyses rather than replacing conventional models. - Edge Computing & Real-Time Decision Making:

Nasdaq’s use of edge computing allows for microsecond-level trade execution while maintaining centralized oversight to prevent errors.

2. Ethical and Privacy Concerns in a Hyperconnected World

- Data Privacy and Usage:

Apple’s differential privacy model showcases how firms can analyze aggregated user data without compromising individual identities. Fintech companies could adopt similar anonymization techniques for customer analytics. - AI Bias and Fairness:

A study showed racial biases in credit scoring algorithms. By slowly rolling out AI with robust testing frameworks, companies like FICO are working to ensure fairness without jeopardizing operational efficiency. - Cybersecurity Threats:

Hedge fund Citadel’s investment in zero-trust architecture highlights the importance of assuming all network traffic is potentially compromised and taking preventive measures accordingly. - ESG Metrics:

BlackRock’s use of Aladdin Climate software ensures portfolios meet ESG benchmarks without compromising returns. The gradual introduction of such tools avoids alienating traditional investors.

3. Emerging Investment Strategies: Navigating a New Era

- Sustainable Investing:

The rise of renewable energy ETFs demonstrates how measured allocations to green portfolios can balance innovation with risk management. - Alternative Data Sources:

Hedge funds like Renaissance Technologies have leveraged satellite imagery for crop yield predictions. However, their success lies in testing alternative data methods on historical datasets before integrating them into live strategies. - Decentralized Finance (DeFi) Opportunities:

Aave offers decentralized lending protocols. Firms that explore DeFi cautiously by using small experimental funds can gain early insights without exposing significant capital. - Hybrid Models:

Morgan Stanley’s AI-supported human advisors showcase the value of combining machine efficiency with human intuition. Gradual integration ensures customers retain trust in the personal touch.

Conclusion: Adapting to the New Normal

The future of fintech and hedge funds lies in measured innovation. Technologies like Agentic AI offer transformative potential, but thoughtful integration is key to sustainable success. Leaders who embrace change with calculated steps will shape the next chapter of financial excellence.

Next steps…

How will you measure your steps in the journey toward innovation? Our approach is process based and responsive. Let’s discuss.

Addendum: Live Links to Examples

- Two Sigma: AI and Machine Learning

- JPMorgan Onyx Blockchain Platform

- D-Wave Quantum Computing

- Nasdaq and Edge Computing

- Apple’s Differential Privacy Model

- FICO and Fairness in AI

- Citadel and Zero-Trust Architecture

- BlackRock Aladdin Climate Software

- Renewable Energy ETFs

- Renaissance Technologies

- Aave’s DeFi Protocols

- Morgan Stanley AI Advisors